Medicare

PCF Senior Benefits, LLC, a member of the PCF family, consists of licensed independent insurance agents and brokers who specialize in Medicare health plans and provide a free consultation and answer questions about what Medicare options may be available to you. Click Contact PCF Senior Benefits or call (385) 478-4544 to discuss your options.

Medicare

PCF Senior Benefits

PCF Senior Benefits represents most of the national Medicare insurance carriers, as well as several regional companies. We advise clients on Medicare Advantage (Part C) plans, Medicare Supplement Insurance policies (Medigap plans), and Medicare drug coverage (Part D).

The availability of Medicare Advantage plans and Medicare Supplement varies from state-to-state, county-to-county.

We recognize that everyone's situation is unique and want to work with you to recommend a plan that's affordable and suitable to your individual needs.

It gives us great pride to serve our clients and help them find the right plan.

Our knowledgeable team will help you find the right plan for your needs at a cost you can afford.

Connect with a PCF Senior Benefits insurance agent today for a free consultation.

Getting the Medicare coverage you need is easy as 1, 2, 3...

STEP 1: Enroll in Medicare Parts A & B

I want to sign up for only Part A or both Part A & Part B

Once you’re eligible to sign up for Medicare (usually 3 months before you turn 65), you have 2 options:

- Sign up to get only Medicare coverage.

- Apply to start getting benefits from Social Security (or the Railroad Retirement Board). Once you’re approved to start getting benefits, you’ll automatically get Part A coverage. You’ll choose if you want Part B coverage when you apply for benefits.

When you’re ready, contact Social Security to sign up:

- Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You’ll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online.

- Call 1-800-772-1213. TTY users can call 1-800-325-0778.

- Contact your local Social Security office.

I have Part A & want to add Part B

- Contact Social Security to sign up for Part B

Medicare Parts A + B

- For Part A, usually no penalties (unless you didn’t pay enough into Social Security and didn't enroll during your Initial Enrollment Period).

- For Part B, premiums will be higher after the Initial Enrollment Period (unless you qualify for an exception).

- What if I work past age 65?

- See the following section "What If I Work Past 65?"

Medicare Part D

- Penalties apply if you don't have any creditable prescription drug coverage and are not enrolled in Part D plan for 63 days or longer at any time after end of Initial Enrollment Period.

Medicare Supplement

- You can apply later but may be charged a higher premium due to existing health problem, or rejected depending on your health history.

Medicare Advantage Prescription Drug Plan (MAPD)

- Wait until the Annual Enrollment Period (AEP), Oct. 15 – Dec. 7.

- You may qualify for Special Enrollment Period (SEP) when certain events happen in your life, like if you move or lose other insurance coverage.

If you keep working or have employer coverage:

- You may enroll in Medicare Parts A and B but not always necessary.

- Recommend talking to your benefit administrator.

- Keep records of your health insurance coverage.

When you are ready to retire:

- If no Part B, you must enroll within 8 months of employment of group health insurance ending or you may be subject to penalty and General Election Period (includes COBRA).

- When retiring, you're eligible for a Special Enrollment Period.

- Allows for 63 days after employer-sponsored coverage ends to enroll in a Medicare plan without penalty – best to sign up before you retire to avoid a lapse in coverage.

STEP 2: Once enrolled in Original Medicare,

determine the additional coverage that is right for you.

Original Medicare

Hospital Insurance

- Most people don't pay a monthly premium

- Inpatient hospital care

- Inpatient mental health care

- Skilled nursing services

- Hospice care

- Some blood transfusions

- $1,600 deductible/admission for a hospital stay of fewer than 60 days

- Stays of more than 60 days require additional daily copays

- Multiple stays may mean multiple deductibles

- Visit any qualified hospital in the U.S. that accepts new Medicare patients

- Hospital care outside the U.S. isn't usually covered

Doctor & Outpatient Visits

- $164.90 monthly premium (may be higher based on income)

- Physician services

- Outpatient hospital services

- Ambulance

- Outpatient mental health

- Laboratory services

- Durable medical equipment (wheelchairs, oxygen, etc.)

- Outpatient physical, occupational therapy

- Some preventive care

- Care available throughout the U.S., but generally not outside the country

- Participating physicians who accept Medicare patients

- $226 annual deductible for 2023

- Medicare pays 80%, you pay 20% of Medicare-approved cost

- No Maximum-Out-of-Pocket (MOOP)

- No prescription drug coverage

Option 1: Medicare Supplement & Prescription Drug Plan (Part D) ($1,200-$2,500 per year)

- Designed to cover what Medicare Parts A & B doesn't – such as deductibles, co-payments, and co-insurance.

- Plans are named A, B, C, D, F, G, K, L, M, N and HDF (except WI, MN, MA).

- Your state may have a six-month guaranteed window that starts when you turn 65 and enroll in Part B. You can apply later but may be charged a higher premium due to existing health problems or rejected depending on your health history.

Pros

- If plan is put together correctly you will have little to no out-of-pocket costs for medical care.

- Goes with you anywhere in the U.S.

- No networks.

- Guaranteed renewable as long as you pay your premium on time and not made any material misrepresentation on your application for insurance.

Cons

- Premium at age 65 starts at $160+ per month. The more comprehensive coverage, the higher the premium.

- In most cases, premiums are based on gender, ZIP code and age.

- Average increase: 6-7%/year.

- Premiums nearly double every 10 years.

- No prescription drug coverage included.

- Helps with cost of outpatient prescription drugs

- Only offered through private insurance companies

- Most states have 25-30 plans

- Each plan has a list of drugs it covers (formulary)

- Make sure your drugs are covered before you enroll in the plan. The list of

drugs changes yearly. - Coverage is not automatic.

- Penalties may apply if you enroll late (1% per month accumulating).

- Average cost for Part D is $35-45 per month

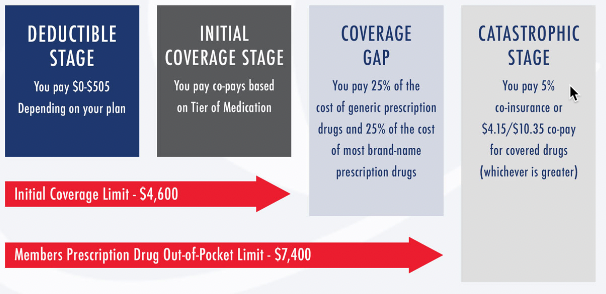

2023 Part D Defined Standard Benefit:

Option 2: Medicare Advantage (Part C) ($0-$500 per year)

- Combines Part A and Part B and, in most cases, includes Part D into one plan

- Offered by private insurance companies (HMO PPO, PFFS, SNP, MSA-No RX)

Pros

- Plan premiums start as low as $0 per month

- Eliminate all deductibles associated with Medicare Part A and Part B

- All plans have a max-out-of-pocket

- Some plans offer additional benefits not covered by Medicare like dental and vision preventive care and gym memberships

Cons

- Copays for most medical services.

- Most plans use networks of doctors and hospitals.

- Coverage may be limited outside the networks unless emergency room (ER) or urgent care.

- Possible to spend more if you reach out-of-pocket (OOP) maximum.

When to enroll in Medicare Advantage?

- During your Initial Enrollment Period

- Annual Enrollment Period (AEP), Oct. 15 – Dec. 7.

- You may qualify for Special Enrollment Period (SEP) when certain events happen in your life, like if you move or lose other insurance coverage.

STEP 3: Let PCF Senior Benefits help you with the application process. It’s FREE!

-

- Option 1 or Option 2.

- Choose the carrier and plan that fits your needs.

- Enroll.

- Yearly review with PCF Senior Benefits.

or call 385-478-4544

MEET OUR TEAM

PCF Senior Benefits group of licensed independent insurance agents who specialize in Medicare health plans can provide a free consultation and answer questions about what Medicare options may be available to you.

MEDICARE PROGRAMS BUILT FOR YOUR NEEDS

Medicare

PCF Senior Benefits

PCF Senior Benefits website is operated by PCF Insurance Senior Benefits, LLC a licensed health insurance brokerage. We are in no way affiliated or endorsed by the Federal Medicare program. We advise our clients on Medicare Advantage plans, Medicare Supplement Insurance policies (Medigap plans), and Medicare drug coverage (Part D). PCF Senior Benefits represents most of the national Medicare insurance carriers, as well as several regional companies. The availability of Medicare Advantage plans and Medicare Supplement varies from state-to-state, county-to-county. Our licensed independent insurance agents who specialize in Medicare health plans can provide a free consultation and answer questions about what Medicare options may be available to you. Neither PCF Senior Benefits nor its agents are connected with the Federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.